[Infographic] Differences Between HSA vs Healthcare FSA

- Renée Sazci

- 1 min read

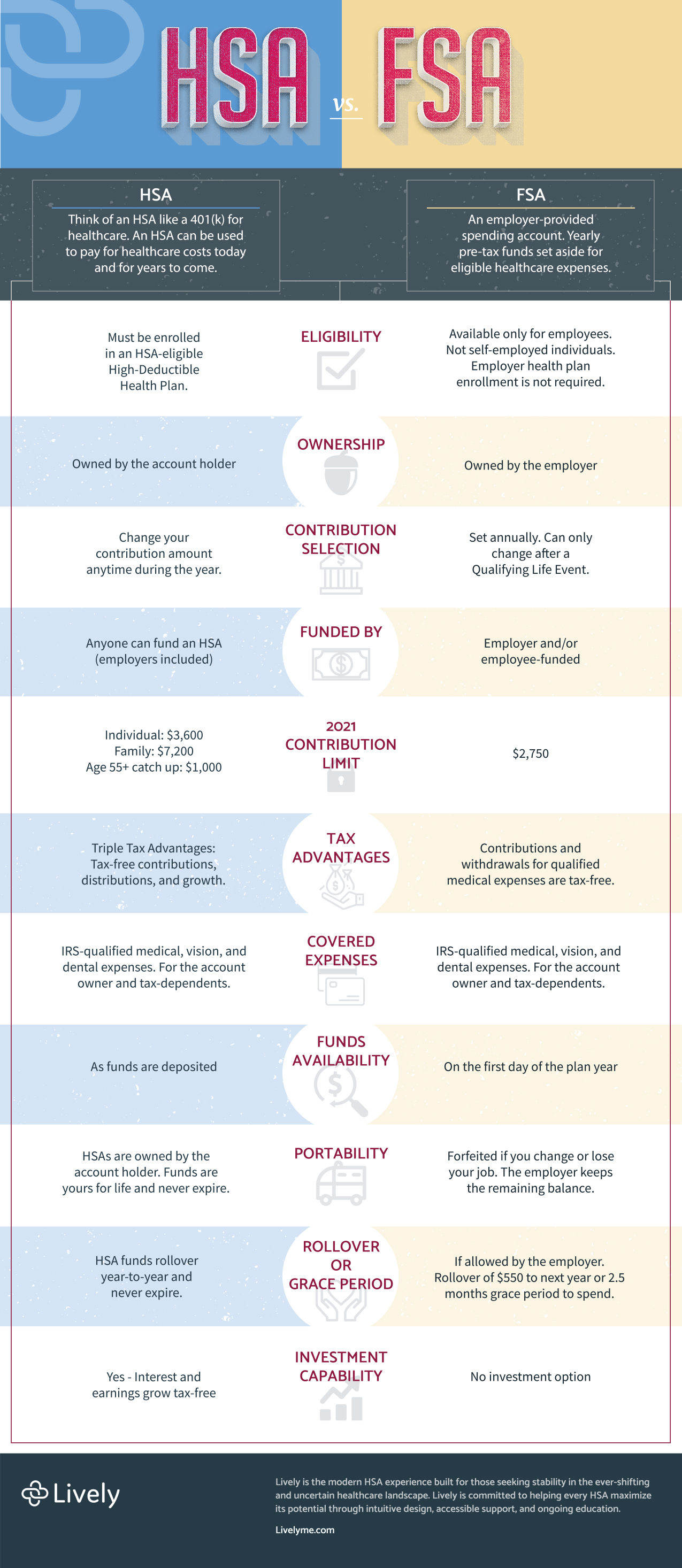

You qualify for an HSA. And your employer offers a Healthcare FSA. Which should you choose? 11 key variables will make one choice better than the other. Discover which in this side-by-side comparison.

You qualify for a Health Savings Account (HSA). And your employer offers a Healthcare Flexible Spending Account (FSA). Which should you choose? To make that decision let’s explore the differences between an HSA vs Healthcare FSA.

HSA vs Healthcare FSA Infographic

HSA vs. Healthcare FSA

Health Savings Account (HSA)

Think of an HSA like a 401(k) for healthcare. An HSA can pay for healthcare costs today and for years to come.

- Eligibility: Must be enrolled in an HSA-eligible High Deductible Health Plan.

- Ownership: Owned by the account holder.

- Funded By: Anyone can fund an HSA (employers included).

- 2021 Contribution Limit: Individual: $3,600; Family: $7,200; Age 55+ catch up: $1,000.

- Contribution Selection: Change your contribution amount anytime during the year.

- Tax Advantages: Triple Tax Advantages: Tax-free contributions, distributions, and growth.

- Covered Expenses: IRS-qualified medical, vision, and dental expenses. For the account owner and tax-dependents.

- Funds Availability: As funds are deposited.

- Portability: HSAs are owned by the account holder. Funds are yours for life and never expire.

- Rollover or Grace Period: HSA funds rollover year-to-year and never expire.

- Investment Capability: Yes - Interest and earnings grow tax-free.

Flexible Spending Account (Healthcare FSA)

An employer-provided spending account. Yearly pre-tax funds set aside for eligible healthcare expenses.

- Eligibility: Available only for employees. Not self-employed individuals. Employer health plan enrollment is not required.

- Ownership: Owned by the employer.

- Funded By: Employer and/or employee-funded.

- 2021 Contribution Limit: $2,750.

- Contribution Selection: Set annually. Can only change after a Qualifying Life Event.

- Tax Advantages: Contributions and withdrawals for qualified medical expenses are tax-free.

- Covered Expenses: IRS-qualified medical, vision, and dental expenses. For the account owner and tax-dependents.

- Funds Availability: On the first day of the plan year.

- Portability: Forfeited if you change or lose your job. The employer keeps the remaining balance.

- Rollover or Grace Period: If allowed by the employer. Rollover of $550 to next year or 2.5 months grace period to spend.

- Investment Capability: No investment option.

Download our infographic and keep it handy when comparing options during open enrollment.

Disclaimer: the content presented in this article are for informational purposes only, and is not, and must not be considered tax, investment, legal, accounting or financial planning advice, nor a recommendation as to a specific course of action. Investors should consult all available information, including fund prospectuses, and consult with appropriate tax, investment, accounting, legal, and accounting professionals, as appropriate, before making any investment or utilizing any financial planning strategy.