Best HR Benefits

- Lively

- 4 min read

Free drinks. Multiple restaurants. Sleep pods. Messages. Lounges. HR benefits feel more like a cruise ship than an office setting these days. As more companies expand benefits offering, in a competitive market, others companies must follow. We are left with a laundry list of benefits – some not worthy of the explanations they require.

Free drinks. Multiple restaurants. Sleep pods. Messages. Lounges. HR benefits feel more like a cruise ship than an office setting these days. As more companies expand benefits offering, in a competitive market, others companies must follow. We are left with a laundry list of benefits – some not worthy of the explanations they require.

What HR Benefits Really Matter

Core HR benefits create important financial security and convenience for employees. They are required to balance a successful work-life balance. When used properly they provide key productivity foundations and support systems for employees. They help with recruitment and ensure high employee retention. Happy employees and company success should go hand-in-hand.

Happy employees and company success should go hand-in-hand.

So where did it all go wrong? Why have we moved away from a few coveted benefits to a laundry list 2 pages long? We don’t want to push a one size fits all mentally. Clearly, the needs of an older employee with a family who is closer to retirement (and has assumed higher health costs) are different than a recent college graduate. Shouldn’t there be a way to find a balanced and synced benefits offering to please all types of employees?

With all of the technology backed HR platforms, why are HR professional stuck with less time and more headaches? Before we dive into those issues, we will layout key benefits and value categories so we can understand potential use cases. This will rank the benefits and show the impact on employee happiness and subsequent company prosperity.

Financial HR Benefits

Financial HR benefits enhance your total compensation package and ensure long-term financial security. They are the most common and costly components benefits. Think of them as base benefits needed to keep employers healthy and financially secure. They are also seeing the largest year over year increase in cost (to both employers and employees).

- Health insurance

- Paid time off (vacation)

- 401k

- Performance pay

- Short and long-term disability

- Commuter benefits

Value HR Benefits

Value HR benefits make employees more productive and happy. They help employees enjoy work, wake up rested and create a positive work environment. It makes work feel less like a job and more like a passion. While the true value of these benefits differs greatly for each employee demographics, they can have a significant impact (revenue, culture, recruitment, retention, and overall company satisfaction) when they are working properly.

- Physical office space

- Flexible work hours

- Working from home

- Google’s 20% rule

- Daycare (on-site)

- Lifestyle perks

- Wellness programs

Convenience HR Benefits

Convenience HR benefits save employees time and make the daily transition from their professional life more seamless and less stressful. It’s hard to measure the financial impact here, for both employees and employers, but these non-intrinsic benefits might be more about marketing and recruiting than employee productivity and happiness.

- Catered meals

- On-site conveniences (laundry services, massage, acupuncture, nap pops, etc.)

Employee Benefits Cost Overview

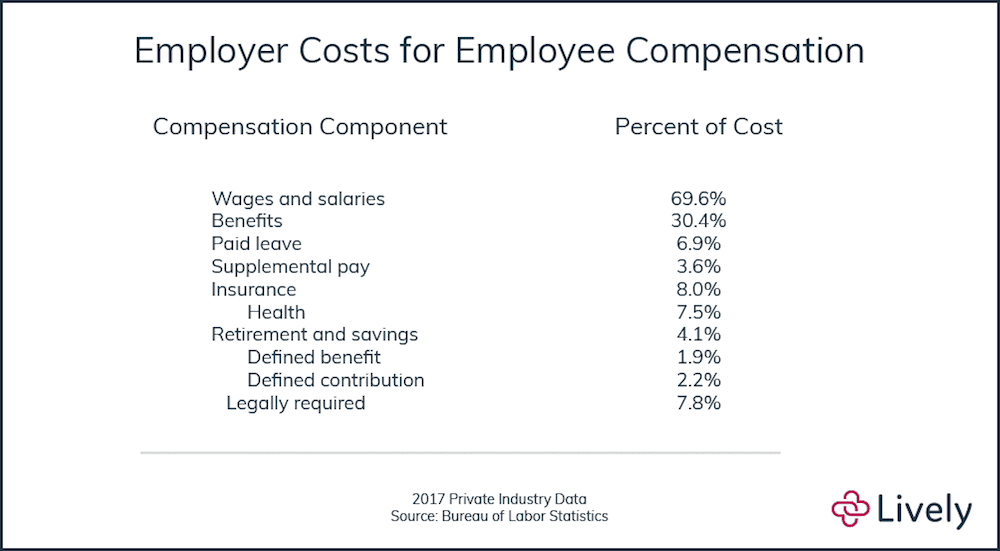

According to the Bureau of Labor, in 2017, employee benefits cost an additional 30% of total compensation, on top of salaries and wages.

As you can see the highest benefits expenses are health insurance (7.5%), paid leave (6.9%) and retirement and savings (4.1%) respectively. To give you a dollar reference, large employers are expected to spend over $14,000 per employee in 2018 on health insurance premiums.

Please note, while most categories are easy to decipher, legal requirements include social security, Medicare, unemployment insurance (both state and federal), and workers’ compensation. Hence they are “legally required” as part of employment in the US. They are the highest percentage of benefits costs, but since they legally required, we considered them outside of the analysis of traditional employees’ benefits.

Benefits Hype vs. Value

It is difficult to assign individual value to some employee benefits (aside from their cost). Younger, healthier employees have very different needs from older, closer to retirement, employees.

Some perks like catered lunches can create PR value and high-return on employee satisfaction. The same might be said of casual attire. Their value is understated in their cost percentage. Understanding benefits purely from an economic perspective changes the value equation.

Educating employees to understand the financial impact of their lives, no matter of age, gender or dependent status, can help employers refocus their benefits needs. The effect can mean less cost for employers and more value for employers, while still delivering the experience employees desire.

Lifetime Employee Benefits

What is further lost in this analysis are financial value employees can take with them when they leave. While healthcare is one of the most expensive yearly costs, it must be renewed with every new plan or calendar year. There is no defined long-term financial value for employers. There is a value to the physical and mental wellbeing of healthy, but benefits like a 401k can be measured in dollars. When you leave your job, you own your 401k. This benefit has created financial security for employees.

You might not know that like the 401k, the HSA creates dedicate financial health savings. Simply put, it’s health savings employees can use anytime for out-of-pocket medical expenses. Adding an HSA ensures your employees can save and invest pre-tax dollars for health expenses. Employees can take these contributions with them if they leave.

An HSA creates the only transferable health benefit. Have you considered adding it to your benefits offering?

Disclaimer: the content presented in this article are for informational purposes only, and is not, and must not be considered tax, investment, legal, accounting or financial planning advice, nor a recommendation as to a specific course of action. Investors should consult all available information, including fund prospectuses, and consult with appropriate tax, investment, accounting, legal, and accounting professionals, as appropriate, before making any investment or utilizing any financial planning strategy.